Continue reading to learn how it works, including the formula to calculate it. The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets. The asset turnover ratio indicates the efficiency with which a company is using its assets to generate revenue. Publicly-facing industries including retail and restaurants rely heavily on converting assets to inventory, then converting inventory to sales.

What Does an Asset Turnover of 1 Mean?

GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology. Keep in mind that a high or low ratio doesn’t always have a direct correlation with performance.

Can the fixed asset turnover be negative?

It varies significantly; capital-intensive industries usually have lower ratios, while service-oriented industries typically have higher ratios due to lower fixed asset investments. The Asset Turnover Ratio takes into account the entire company’s assets, so they include cash, inventory, as well as fixed assets. In order to improve the FAT ratio, you need either increase the revenue while fixed assets stay on the same level or decrease the value of the fixed assets. In the above formula, the net sales represent the total sales made and the revenue generated form it after taking away any discounts, allowances or returns. The Fixed Asset Turnover Ratio (FAT) is found by dividing net sales by the average balance of fixed assets. Irrespective of whether the total or fixed variation is used, the asset turnover ratio is not practical as a standalone metric without a point of reference.

- Analysts and investors often compare a company’s most recent ratio to historical ratios, ratio values from peer companies, or average ratios for the company’s industry.

- This ratio measures the amount of revenue a company is generating through the use of its fixed assets, such as property, plant, and equipment, relative to the cost of those assets.

- The asset turnover ratio is calculated by dividing the net sales of a company by the average balance of the total assets belonging to the company.

How can a company improve its Fixed Asset Turnover ratio?

This is because the fixed asset turnover is the ratio of the revenue and the average fixed asset. And since both of them cannot be negative, the fixed asset turnover can’t be negative. You should also keep in mind that factors like slow periods can come into play.

Strategies to Improve Your Fixed Asset Turnover Ratio

The average value of the assets for the year is determined using the value of the company’s assets on the balance sheet as of the start of the year and at the end of the year. Total sales or revenue is found on the company’s income statement and is the numerator. While it indicates efficient use of fixed assets to generate sales, it says nothing about the company’s ability to generate solid profits about wheres my refund or maintain healthy cash flows. Fixed Asset Turnover is a crucial metric for understanding how well a company uses its fixed assets to drive revenue. It provides valuable insights for investors, analysts, and management, helping to gauge operational efficiency and inform strategic decisions. Inadequate maintenance or lack of demand for products or services can also contribute to a low ratio.

Additionally, it is important to consider the age and condition of your fixed assets when interpreting the fixed asset turnover ratio. If your company has recently invested in new, modern equipment, it may take some time for the revenue generated from these assets to be reflected in the ratio. On the other hand, if your fixed assets are outdated and require frequent maintenance, this may negatively impact the ratio and suggest a need for investment in new equipment. Therefore, it is important to not only analyze the ratio itself, but also the underlying factors that may be influencing it.

Since the total asset turnover consists of average assets and revenue, both of which cannot be negative, it is impossible for the total asset turnover to be negative. Just-in-time (JIT) inventory management, for instance, is a system whereby a firm receives inputs as close as possible to when they are needed. So, if a car assembly plant needs to install airbags, it does not keep a stock of airbags on its shelves but receives them as those cars come onto the assembly line. As you can see, Jeff generates five times more sales than the net book value of his assets. The bank should compare this metric with other companies similar to Jeff’s in his industry. A 5x metric might be good for the architecture industry, but it might be horrible for the automotive industry that is dependent on heavy equipment.

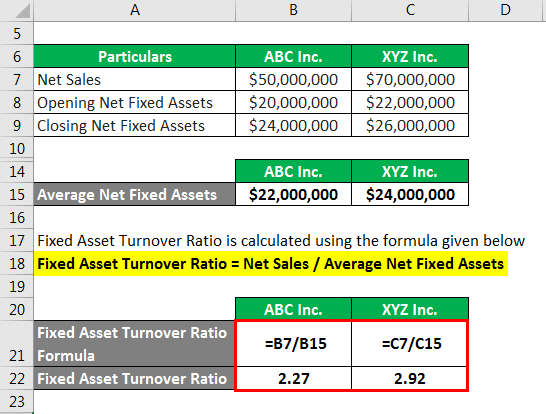

Therefore, Apple Inc. generated a sales revenue of $7.07 for each dollar invested in fixed assets during 2018. Let us see some simple to advanced examples of formula for fixed asset turnover ratio to understand them better. Once this same process is done for each year, we can move on to the fixed asset turnover, where only PP&E is included rather than all the company’s assets. As with all financial ratios, a closer look is necessary to understand the company-specific factors that can impact the ratio.

The best approach for a company to improve its total asset turnover is to improve its efficiency in generating revenue. For instance, the company can develop a better inventory management system. The following article will help you understand what total asset turnover is and how to calculate it using the total asset turnover ratio formula. We will also show you some real-life examples to better help you to understand the concept. Though ABC has generated more revenue for the year, XYZ is more efficient in using its assets to generate income as its asset turnover ratio is higher.

Other sectors like real estate often take long periods of time to convert inventory into revenue. Though real estate transactions may result in high profit margins, the industry-wide asset turnover ratio is low. As technology continues to advance and markets evolve, the fixed asset turnover ratio is likely to become an even more critical metric for companies across a range of industries.

A common variation of the asset turnover ratio is the fixed asset turnover ratio. Instead of dividing net sales by total assets, the fixed asset turnover divides net sales by only fixed assets. This variation isolates how efficiently a company is using its capital expenditures, machinery, and heavy equipment to generate revenue. The fixed asset turnover ratio focuses on the long-term outlook of a company as it focuses on how well long-term investments in operations are performing. Finally, companies may overlook the impact of depreciation on the fixed asset turnover ratio.